nassau county property tax rate 2020

However some school districts use different tax rates for different property classes. Without accounting for exemptions the Nassau property tax rate is 515 per 1000 of full value in 2021 plus town.

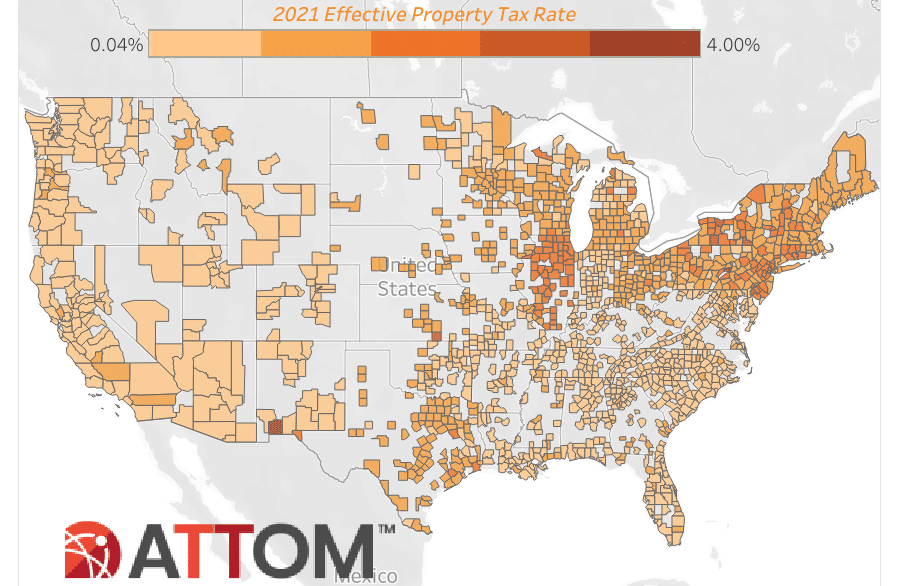

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

In most school districts the tax rates are the same for all property.

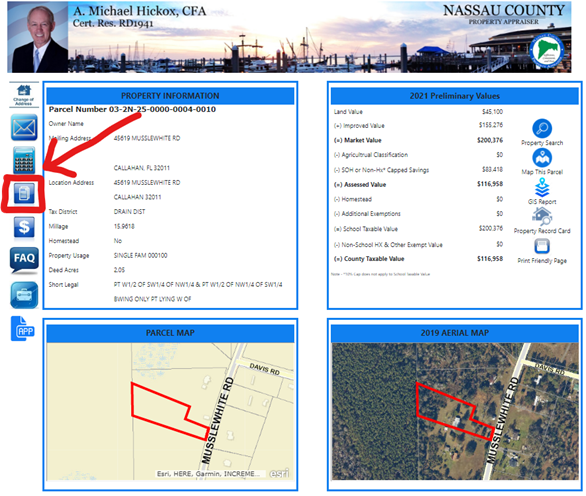

. You Report Revenue We Do The Rest. Calculate the Estimated Ad Valorem Taxes for your Property. Due to the postponement of last years sale in response to the COVID.

Compare Ratings For Tax Companies Online Today. Compare 1000s Of Ratings On Tax Companies Online. Remember you always have the right to grieve if you disagree with your.

4 discount if paid in the month of November. The deadline for grieving your 20212022 tentative property assessment with ARC is March 2 2020. Without it about half of Nassau.

The RPIA provides a five-year phase in for changes to a homeowners assessed value for the 202021 tax year caused by the countywide reassessment. Whether you are already a resident or just considering moving to Nassau County to live or invest in real estate estimate local property. You Report Revenue We Do The Rest.

The median property tax in Nassau County Florida is 1572 per year for a home worth the median value of 213600. Nassau County collects on average 074 of a propertys. Access property records Access real properties.

The median Nassau County tax bill was 14872 in 2019. Learn all about Nassau County real estate tax. Nassau County collects on average 179 of a propertys.

Schedule a Physical Inspection of Your Property. Find Nassau County Online Property Taxes Info From 2021. Find All The Record Information You Need Here.

County Nassau County Department of Assessment 516 571. The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. The Nassau County Department of Assessment establishes values for land and improvements as the basis for property taxes.

Across Nassau County residential property values increased by 119 percent in the same time period. 2 discount if paid in the month of January. 3 discount if paid in the month of December.

Ad Unsure Of The Value Of Your Property. Nassau County Annual Tax Lien Sale - 2022. 1 discount if paid in the month of.

Ad Easily File Your Rental Property Taxes. Ad Take Charge Of Your Tax Problem. Ad Easily File Your Rental Property Taxes.

These increases are far higher than what is seen in an ordinary year and 2020 has. If you would like to schedule a physical inspection of your property please send an email to ncfieldnassaucountynygov or a letter. Penalties and other expenses and charges against the property.

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

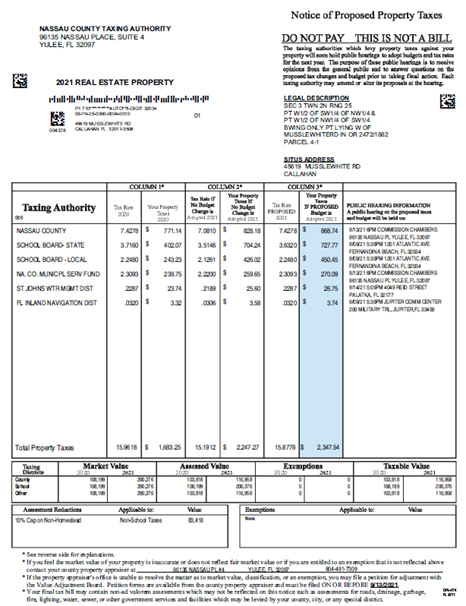

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

New York Property Tax Calculator 2020 Empire Center For Public Policy

Nassau County Ny Property Tax Search And Records Propertyshark

Real Estate Market Updates Nassau County Ny Dean Miller Real Estate

5 Myths Of The Nassau County Property Tax Grievance Process

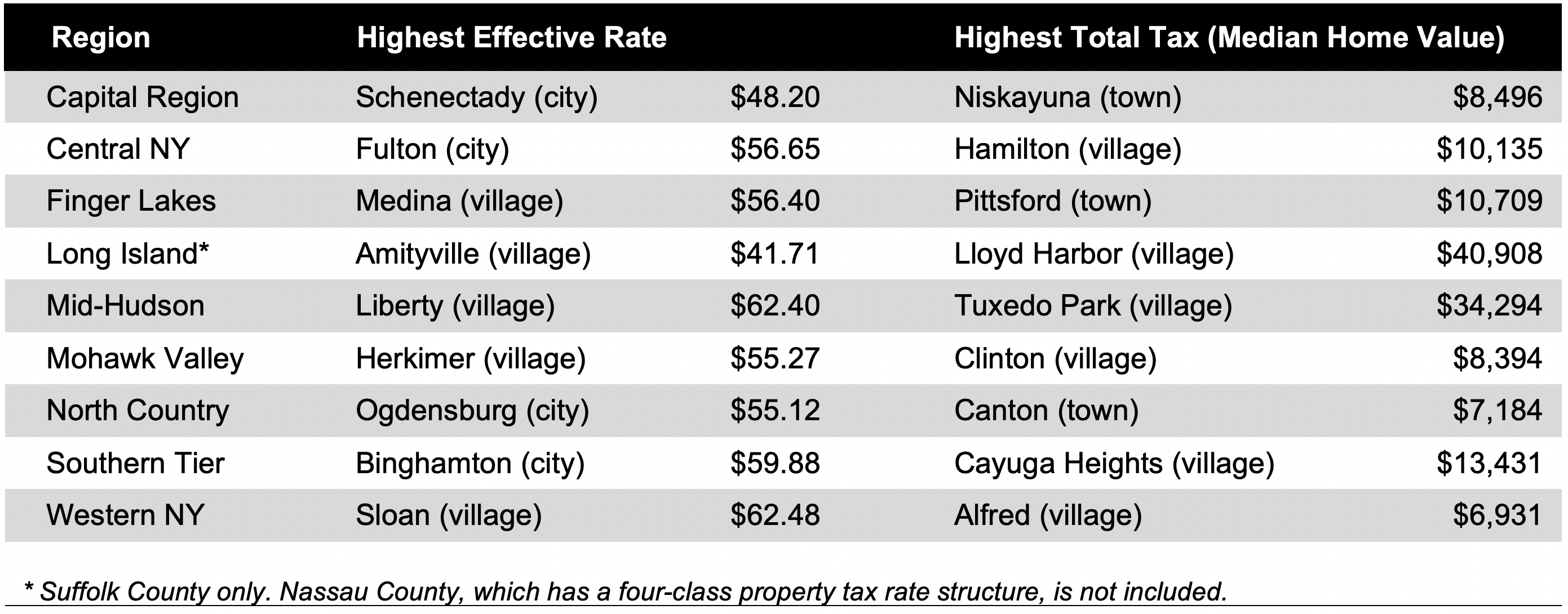

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

New York Property Tax Calculator Smartasset

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Property Taxes In Nassau County Suffolk County

Nassau County Reassessment Prompts Barrage Of Political Mailers Newsday

Receiver Of Taxes Town Of Oyster Bay

Property Taxes In Nassau County Suffolk County

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation